Copper had one of its best years ever in 2017, rising 27% on the back of supply disruptions and steady demand from China, by far the largest copper consumer.

Commodities analysts are usually wrong about copper supply, always predicting a glut in the market for the ubiquitous metal used in everything from piping for plumbing to wiring in houses, to components of electric vehicles. What they fail to account for is the inevitable stoppages at the major copper mines due mostly to strikes and weather problems.

Commodities analysts are usually wrong about copper supply, always predicting a glut in the market for the ubiquitous metal used in everything from piping for plumbing to wiring in houses, to components of electric vehicles. What they fail to account for is the inevitable stoppages at the major copper mines due mostly to strikes and weather problems.

In 2017 however they were right. In January last year a collection of analysts—from BMI, Goldman Sachs, Citigroup) and TD—were all bullish on copper, saying that after a terrible 2015 and 2016, it would be the strongest performing metal of 2017 with predictions of up to $6,200 a tonne come mid-year. By the end of 2017 copper futures trading on the London Metal Exchange (LME) were at their highest in four years, $7,236.50 a tonne or $3.28 a pound. Copper wasn’t the best performing metal of 2017 (that would be cobalt) but it was third behind palladium.

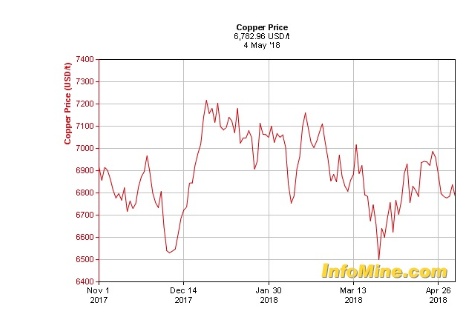

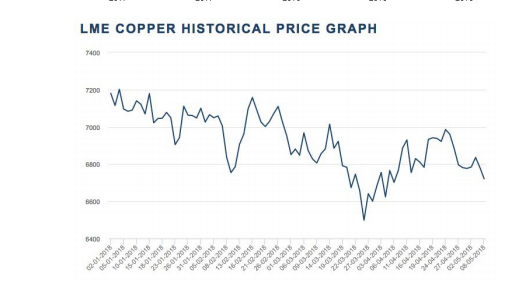

So how has copper done so far in 2018? The base metal is showing a V-shaped curve, with LME copper starting the year at $7,200 a tonne, bottoming out at $6,499 on March 26, and currently trades at $6,721. Spot copper follows the same pattern. It started 2018 at just under $7,200 and was at $6,782 ($3.08) as of May 4. Copper has traded up sharply since the end of March but has pulled back since the end of April.

Copper Price in USD

LME Copper, Historical Price Graph

So what's happening with the copper market and what are the prospects for junior copper companies wanting to find the next big discover to be gobbled up by a major? The article embedded below takes a look at the copper market in detail, including uses, the supply-demand trends and pricing.

However, the overall conclusion, based on the details provided, is that copper is heading for a major shortfall. That can only mean one thing: higher prices