sell nifty 10500 sl 10540 target 10460/10420/10380

Which is massages given in this blog it's just our opinion trading is ur own risk we are not responsible for profit & loss

Thursday 1 March 2018

Wednesday 28 February 2018

Crude Oil And Trump's Biofuels Meeting

President Trump called a meeting with key senators and Cabinet officials to discuss potential changes to the biofuels policy, which is coming under increasing pressure after a Pennsylvania refiner blamed the regulation for its bankruptcy. The meeting comes as the Oil industry and Corn lobby which are both powerful forces in Washington clash over the future of the Renewable Fuel Standard (RFS), a decade old regulation that requires refiners to cover the cost of mixing biofuels such as Corn-based Ethanol in their fuel. This news story reported by Jarrett Renshaw with Thomson Reuters. The USDA also projects a drop in Corn production to 14.390 billion bushels from 14.604 previously. In the overnight electronic session the March Corn is currently trading at 367 ¾ which is 1 ½ of a cent higher. The trading range has been 368 ¼ to 366 ½.

On the Ethanol front the April contract is currently trading at 1.488, which is .004 higher. The trading range has been 1.495 to 1.488. The market is currently showing 2 bids @ 1.487 and 1 offer @ 1.495 with 10 contracts traded and Open Interest at 982 contracts.

On the Crude Oil front the market is easing on prices with expectations of builds in the API Energy Stocks data tomorrow. In the overnight electronic session the April Crude Oil is currently trading at 6325, which is 30 points lower. The trading range has been 6390 to 6323. We could see further profit taking.

On the Natural Gas front the March contract expires today and new weather reports of a cold March looming has prices higher on this oversold market. In the overnight electronic session the April contract is currently trading at 2.697, which is 4 cents higher. The trading range has been 2.723 to 2.670.

Beware Natural Gas Shortage

From glut to shortages. During downturns in major commodity markets there is a tendency to get all doomy and gloomy about the future and get locked into a lower than longer mentality. That kind of short term thinking has engineered a major bottom in petroleum and now that type of thinking may make an on impact natural gas.

In the U.S., we fear a market collapse on Henry Hub natural gas in the spring, as record production should refill storage and cause a U.S. glut. In the big picture, we are sowing the seed of a future shortage. Shell (NYSE:RDSa) is warning that despite the global glut of natural gas we are on the path to a major Liquified Natural Gas LNG shortage.

Royal Dutch Shell says the world could face a shortage of liquefied natural gas within a decade because of underinvestment in new projects and because of what should be a major demand surge during that time as users will increase their usage of natural gas because of the current cheap prices and the environmental benefits of natural gas. Shell warns in its annual LNG outlook, that because of low prices the demand for liquefied natural gas grew by 29M metric tons last year, 30% more than previously expected, to 293M tons.

Shell says that they expect LNG demand to grow by a explossive 500M metric tons/year by 2030. Supplies on the other hand will fall by 300M tons/year due to a lack of new projects and natural declines in existing production. LNG buyers should heed the warning as long term hedges at this point are relatively cheap but thinly traded. While this is a problem for down the line, it is not too early to be getting prepared. Speculators though can sell this market in the short term in the U.S. because we will see more production in the coming months and a bit of a pullback in demand.

Oil prices gain ground after early weakness as the U.S. stock market shot to the sky. This helped oil overcome worries about a potential large increase in weekly supply and more refineries going into maintenance. Saudi Arabia was making news overnight. Reuters reported that Saudi Arabia’s King Salman reshuffled some of the kingdom’s top military officers and several deputy ministers on Monday, in a broad shakeup seen as elevating younger officials in key economic and security areas. This comes as the war in Yemen is dragging on and has not gone well for the Saudis.

Yet, what may move oil today is the testimony by Fed Chair Jerome Powell. His job is to not rock the boat and if he comes off well, and not too hawkish, then stocks and oil will build on yesterday’s gains. If not, we’ll just be prepared for some volatility.

There was also a lot of talk about the future of fracking techniques that could make shale production much better in the future. The Financial Post reported shale drilling is about to take a gigantic leap forward with a new “3 dimensional” technique called cube development.

The Post writes that modern day shale drilling, which combines fracking with horizontal drilling, has largely been a 2-dimensional activity–drilling horizontally through a single shale layer to extract gas from tiny pockets within the shale. But there’s more than one shale layer commercially viable. Here in the northeast we have three layers actively drilled: the Marcellus, the Utica, and the Upper Devonian.

Until now, drillers have targeted a single layer. Sometimes they use the same vertical well bore to target a different layer–but that’s the exception rather than the rule. The rule is changing. In Texas and a few other locations, drillers are experimenting with drilling all the commercially viable shale layers at once–3D style. Encana has a “cube development” (3D) Texas well pad that sits on 16 acres. The pad hosts 19 shale wells and pumps 20,000 barrels of crude oil a day! Devon Energy (NYSE:DVN) has a 24-well pad project in Oklahoma. And others are giving it a try too. Of course while you can produce more you will also deplete formations faster but that too is a problem for another day.

RBOB futures are looking cheap as we get the lull before the summer time blend run-up. With U.S. gasoline demand on track to break records this summer we should get a very strong rally on RBOB soon. The summer switchover season is starting and as we start to see spring return, the RBOB futures should spike. Make sure you are hedged and look for opportunities to buy.

Truckers have also received a break in diesel prices after a sustained run-up but that too may be short lived. Since the beginning of February, fuel prices have dropped approximately 7 cents after rising about 11 cents over the first five weeks of the year. According to the Department of Energy’s weekly report, the U.S. average price for a gallon of on-highway diesel is now $3.007 as reported by CC news. Yet, with late winter demand from Europe and anticipated seasonal crop planting demand around the corner we should see those price rebound in a few weeks.

Grain prices are still being supported by the lack of rain in Argentina and that could support ethanol prices. DTN reports that President Donald Trump has invited federal lawmakers at the center of the Renewable Fuel Standard debate to a meeting at the White House today to discuss potential reform DTN has not been able to confirm such a meeting is scheduled, and representatives of biofuel groups contacted by DTN said they have not received an invitation to participate. Earlier this week, Sen. Ted Cruz, R-Texas, held a rally with employees at the now-bankrupt Philadelphia Energy Solutions refinery. He called for reform to the RFS, after PES alleged in a Chapter 11 bankruptcy filing that $832 million in costs to comply with the RFS was the reason for its demise. During that rally, Cruz said biofuels groups had "refused" to meet with him and other members of Congress to talk about potential changes to the RFS. Stay tuned.

China PMI Raises Questions About Copper Outlook

With the end of February, China puts itself in the spotlight with the first major PMI results of all the major economies, and major economy is the key word as China's influence across global markets only grows by the year. The February manufacturing PMI came in at 50.3 (51.2 expected, 51.3 previous), and the non-manufacturing PMIat 54.4 (55.0 expected, 55.3 previous). So, some pretty soft results. The timing of the Chinese new year no doubt played some role (taking place in the middle of February - and hence shutting things down for a couple of weeks around the 1-week national holiday), so we'd need to see March data to confirm, but it still a weak result nonetheless.

On the details, within the manufacturing PM, large firms were down -0.4pts to 52.2 vs small firms down a sharp -3.7pts to 44.8 - highlighting the pressure facing smaller firms which receive less support from the government and are generally more sensitive to changes in economic activity. Within the non-manufacturing PMI, the Services PMI was down -0.6pts to 53.8, while the Construction PMI was down -3.0pts to 57.5 - which lines up with the slowing in property price gains.

So overall, within the data there was not much to get excited about. And looking at a key China-sensitive market, the outlook for copper prices is left with some looming questions...

The key takeaways from the February China PMIs are:

- The February China PMI data was materially weaker vs January and consensus expectations. Chinese New Year likely had some impact, but it was still a weak result.

- The soft data, even if it proves to be temporary, leaves question marks looming on the outlook for copper prices.

- Looking at the copper and government bond markets there are a couple of key divergences, which highlight double-edged risks in copper prices and bond yields.

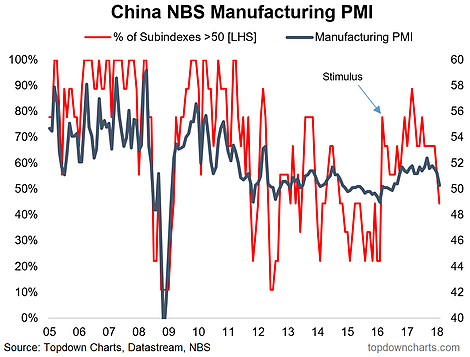

1. China Manufacturing PMI: This chart shows the breadth of the components that make up the NBS China manufacturing PMI. You can clearly visualize the moment China stepped up stimulus measures in early 2016, while the rebound in global tradeand commodities and weakening CNY also helped. Whereas now you can see the impact of waning stimulus tailwinds (which were already in play) and with the latest results accentuated to the downside by Chinese new year distortions.

China NBS Manufacturing PMI

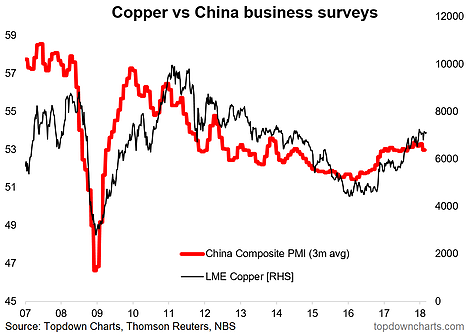

2. China PMI vs Copper Price: This chart was a key one in picking the medium-term bottom in copper prices, so it's one to keep watching - with China still the number one worldwide consumer of copper, any change in the cyclical outlook in China is going to ripple across copper markets (and industrial metals). The latest results show a blip down in the composite smoothed PMI (the 3-month rolling combined manufacturing + non-manufacturing PMI). Even though Spring Festival effects likely accentuated the weakness in the data, it does leave some questions around the outlook for copper prices.

Copper Vs China Business Surveys

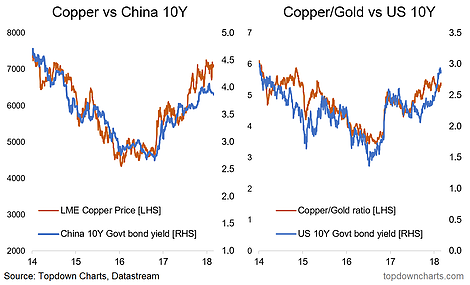

3. Copper and Bonds: Any chance to talk about 10-year bond yields—looking at 2 key intermarket analysis charts there are some slightly mixed signals. The first one, Copper vs the China 10-year Government Bond Yield is showing a slight but noticeable divergence. Either copper is wrong and the conclusion is bearish copper, or the bond market is wrong and Chinese bond yields are set to rise. By contrast the copper/gold ratio has lagged behind the rise in the US 10-year bond yield, and in this one either bond yields have gone too high or copper is due some upside. Given the softness in the PMIs, it may well be that copper and bond yields take a breather.

Copper vs China 10Y : Copper/Gold vs UST 10

Monday 26 February 2018

Subscribe to:

Posts (Atom)

Followers

-

sell gold 28675 stop loss 28730 target 28620/28580

-

Gammon India Ltd., a Mumbai-based civil engineering construction company, slipped Monday after fiscal first quarter widened on lower sa...

-

silver all targets achieved