nickel 3rd target achieved

Nse trader, mcx traders, ncdex traader ,stock futer trader ,options trading

Monday, 14 May 2018

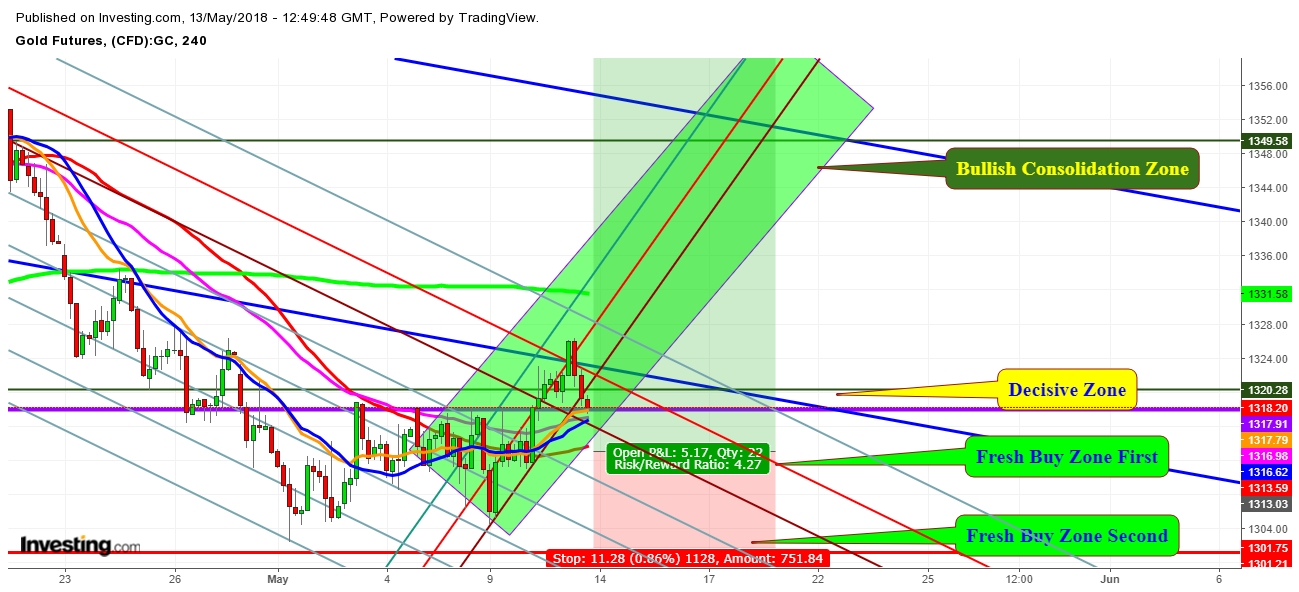

Gold: Outlook For The Week Of May 13th, 2018

Since my last analysis, Gold futures have found good support at the level of $1318 and look ready to retreat towards $1329 and further to $1355 levels during the upcoming week.

I expect Gold futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

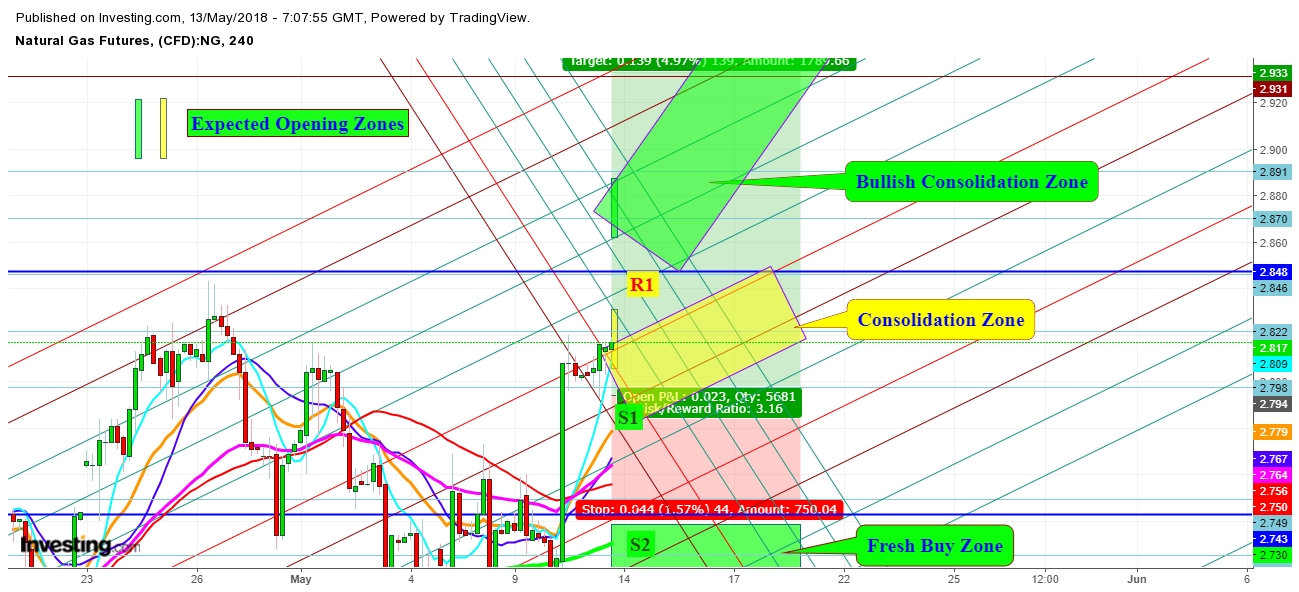

NG Looks To Consolidate In Upper Range During Week Of May 13th, 2018

Since my last analysis, I've found that Natural Gas Futures look ready to consolidate in an upper range now. Amid the expected impact of supply and demand, the equation is about to tilt from decreasing demand during winter to growing demand with the above-average temperatures covering most of the country through mid-May. No doubt that the record high domestic production levels have overshadowed the fact that gas stocks are well below their seasonal averages for this time of year. Such scenario during mid May to last week of June always results in growing volatility.

I expect the Natural Gas futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Subscribe to:

Comments (Atom)

Followers

Stock market updates

buy LT 3800-3810 stop loss 3780 target 3835/3900/3950

-

buy LT 3800-3810 stop loss 3780 target 3835/3900/3950

-

At Nagpur market , Soybean Plant ended lower at Rs. 3250-3300 per quintal, lower by 1.49 per cent as compared to previous day. Soybean Mandi...

-

buy bank nifty@49200 sl 49000 target 49400/49600/49800 Recommendation: Buy Bank Nifty @ 49,200 Stop Loss (SL): 49,000 Targets: 1st Target: ...