buy apollo tyres @290 sl 282 target 298/306/314

Nse trader, mcx traders, ncdex traader ,stock futer trader ,options trading

Showing posts with label stock tips. Show all posts

Showing posts with label stock tips. Show all posts

Tuesday, 15 May 2018

Monday, 14 May 2018

Bitcoin Daily Forecast - 14 May 2018

Bitcoin outlook negative despite a bounce in oversold conditions. We are holding strong resistance at 8650/8750 and should turn lower. Holding below 8600 targets 8500 and 8350 before the low at 8210/00. A break lower is expected eventually targeting 7800 and the the most important of the week at 7550/7500. We should bounce off here on the first test to ease oversold conditions. I do not think this level will hold for ever though.

Strong resistance at 8650/8750 but shorts need stops above 8850. An unexpected break higher targets 8900/8950 and 9050, perhaps as far as 9180/9200, but look for a selling opportunity at 9250/9300.

Crude Oil Prices Up After Geopolitical Issue Eases

The oil prices were bullish in the market as geopolitical tensions in the Middle East dies down. The commodity’s prices managed to hit another milestone despite the astonishing performance of the dollar in the market.

The commodity continues to push great performance in the market on multiple factors. The great oil inventories reports and the OPEC agreement to extend the output cut have managed to put the prices on its best figures ones again.

Furthermore, the recent decision from the Trump administration was the last greatest factor that managed to buoy the oil prices in the market. The administration recently announced their plan to revokes the nuclear deal with Iran, easing some of the geopolitical tension and debacle in the Middle East.

The tension mostly came from the Iran and U.S.A. deal which also dragged the commodity’s prices down in the market this week. Most of the pressure came from the announcement of the U.S.A. about rethinking the possibility of leaving the Iran nuclear deal which will, in return, severely affect the ongoing oil exports from the country.

Oil Prices

Both the Brent Crude and the U.S. West Texas Intermediate were tallying greater returns in the market today. The Brent crude managed to increase by a massive 19 cents in the previous session, settling at a $77.40 a barrel.

The West Texas Intermediate or WTI also managed to hit the lucrative $71 per barrel price on the same market session. The deliveries for June in the New York Mercantile Exchange also managed to increase by a total of 22 cents, settling at $71.36 a barrel.

Furthermore, the oil price increases just after the Treasury Secretary expressed his thoughts on the oil prices on a previous report. Secretary Steven Mnuchin noted that he is not expecting a huge market movement in the coming session as countries is reportedly increasing their output to offset some of the losses they experienced.

Last week’s oil prices were also pressured after their tremendous run. The stockpiling oil inventories are looking to take hold of the oil prices this week as they keep pestering the global stock figures. According to reports, the Oklahoma storage hub was up by a total of 479,644 barrels to the terrifying 39.56 million barrels.

Analysts are also looking for the possibility of the oil prices running unexpectedly wild. Some of reports and analysis are pointing that the prices may hit the $100 price per barrel just before the year ends.

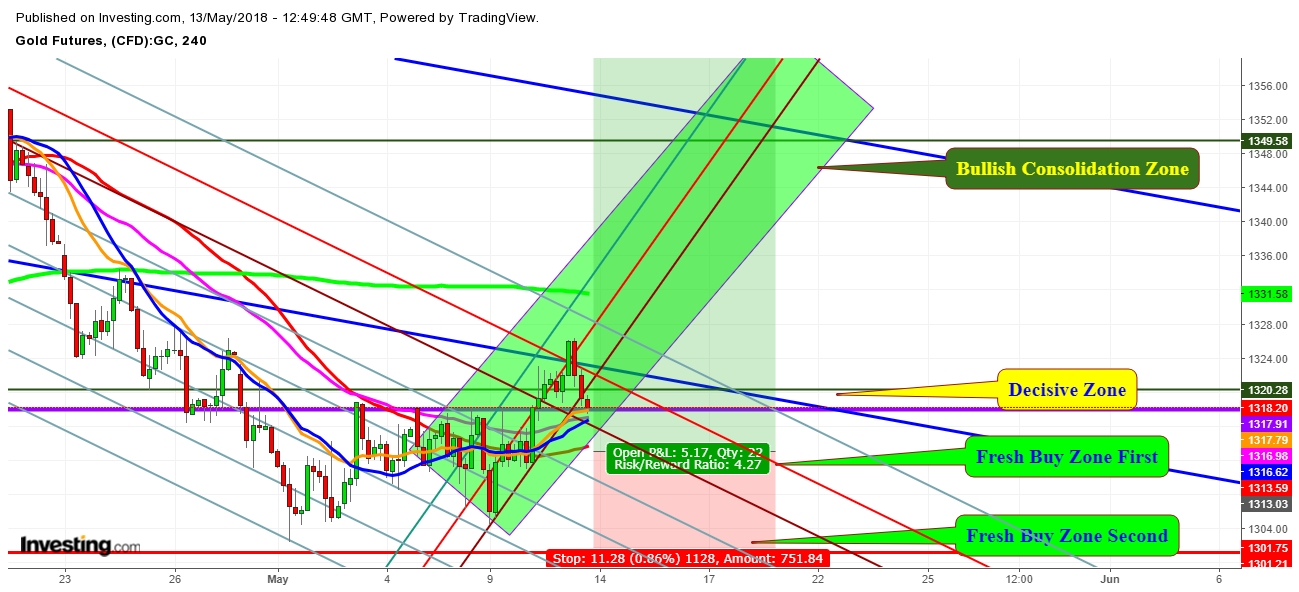

Gold: Outlook For The Week Of May 13th, 2018

Since my last analysis, Gold futures have found good support at the level of $1318 and look ready to retreat towards $1329 and further to $1355 levels during the upcoming week.

I expect Gold futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

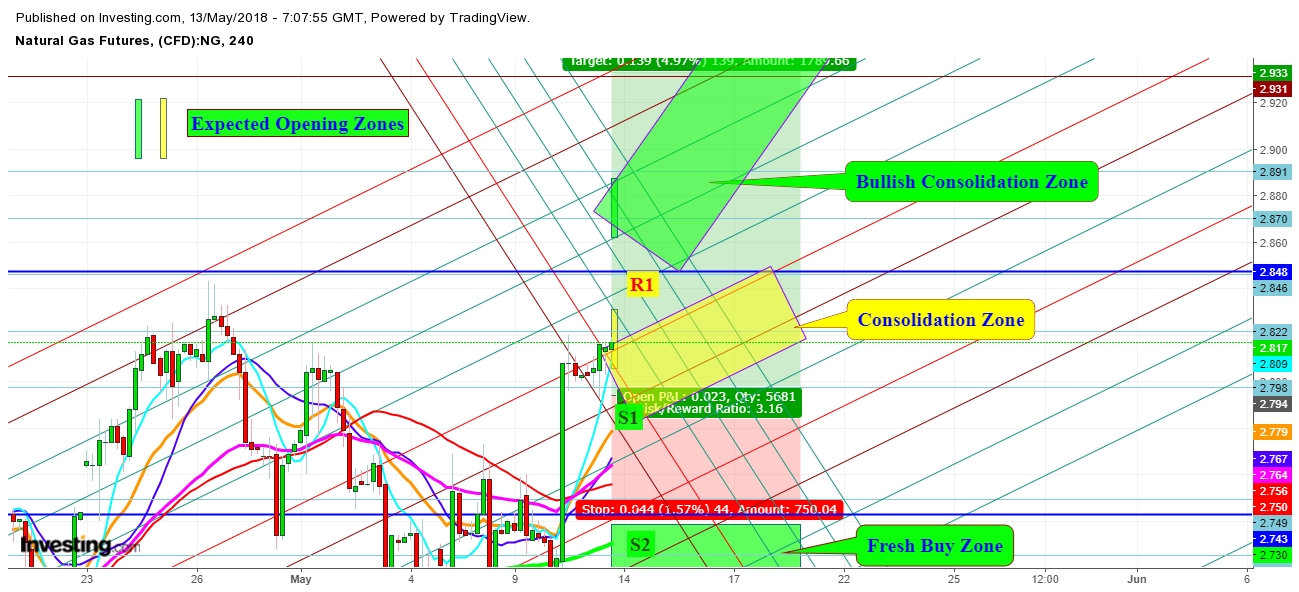

NG Looks To Consolidate In Upper Range During Week Of May 13th, 2018

Since my last analysis, I've found that Natural Gas Futures look ready to consolidate in an upper range now. Amid the expected impact of supply and demand, the equation is about to tilt from decreasing demand during winter to growing demand with the above-average temperatures covering most of the country through mid-May. No doubt that the record high domestic production levels have overshadowed the fact that gas stocks are well below their seasonal averages for this time of year. Such scenario during mid May to last week of June always results in growing volatility.

I expect the Natural Gas futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

EUR/USD: Sell Climax Bouncing To 1.2000

The EUR/USD daily chart collapsed in a series of sell climaxes. The odds favor a bounce to resistance at the 20-day EMA and the top of the most recent leg in the climax. That leg was the 4-bear bars down to the low of 2 days ago.

The EUR/USD daily Forex chart is in a strong bear trend. Yet, because it has fallen in a series of strong bear legs within a tight bear channel, the selloff is climactic. That is a parabolic wedge sell climax. There is a 60% chance of a rally to the top of the most recent small leg in the climax. That is the top of the 4 final bear bars, and it will be around the 20 day EMA.

Furthermore, a bounce from a sell climax usually has at least 2 small legs and lasts about half as long as the sell climax. Since the selling took place over 4 weeks, the 150 – 200 pip sideways to up move will probably last at least a couple of weeks.

Is the bottom in? When a bear channel is tight, the bulls usually need some kind of micro double bottom before they can get their rally. Therefore, there will probably be at least a small pullback in the bear rally within a few days. That will qualify as a micro double bottom and be the start of a small 2nd leg up.

Parabolic wedge bottoms have a 30% chance of reversing into bull trends without a major trend reversal bottom. Therefore, there is a 70% chance that the rally over the next 2 weeks will either be a bear flag or a bull leg in a trading range.

In either case, there will probably be a test down to around this week’s low. Since there is important support down at the December 12 low of 1.1717 and the November 5 low of 1.1553, the odds favor lower prices over the next couple of months.

Weekly Chart Forming A Reversal Bar

The 2-day reversal has turned the bar on the weekly chart into a reversal bar. The market is now trading around the open of the week. If the day closes above this week’s open, the weekly bar will have a bull body.

While this week’s reversal is good for the bulls, the 2 weeks before were big bear trend bars. Consequently, this week will probably not be enough for the weekly bull trend to resume. Instead, it will probably lead to a pause in the selling for a couple of weeks. The odds are that the bulls will need at least a micro double bottom on the weekly chart before the bulls can regain control.

In addition, the strong December rally begin with the 1.1717 low. The odds are that the weekly chart will have to get there over the next month or so before the bulls will have a reasonable chance of regaining control on the weekly chart.

Overnight EUR/USD Forex Trading

The EUR/USD 5-minute Forex chart rallied about 60 pips overnight. Since this rally is either a bear flag or a bull leg in a trading range, it will probably be weak. Yet, the odds favor higher prices over the next 2 weeks. Consequently, the bulls will buy selloffs.

Furthermore, since the bears know that the daily chart is still in a bear trend, they will sell rallies. Both the bulls and bears know that a trend up or down on the daily chart is unlikely for at least 2 weeks, both will be mostly scalping for 20 – 30 pips.

The swings will soon get smaller, and day traders will then have to scalp for 10 pips. Swing trading bulls will buy dips and hold for a test of 1.2000. Swing trading bears will probably wait for a test of resistance at around 1.2000

Subscribe to:

Comments (Atom)