buy silver@ 38300 sl 38100 target 38500/38600/.38700

Nse trader, mcx traders, ncdex traader ,stock futer trader ,options trading

Tuesday, 20 February 2018

LNG Comes To Boston, A Harbinger Of The Future?

The most curious natural gas story of the year so far comes out of Boston and seems to have echoes of a deepening Russia-related scandal in Washington. A liquefied natural gas (LNG) tanker bearing natural gas produced in part in Russia delivered its cargo to the Boston area for insertion into the natural gas pipeline system there. Apparently, the Russian company that supplied some of the gas may fall under U.S. sanctions against the financing and importation of Russian goods.

One of the many ironies of the delivery is that the United States is simultaneously importing LNG in one place even as it exports LNG from another. (I'll explain later why this may become a more frequent occurrence in the years ahead.)

The hue and cry from the natural gas partisans blamed Boston's predicament on the lack of pipelines to carry growing gas production from the nearby Marcellus and Utica shale deposits to needy Bostonians whose gas supplies had been depleted by a deep winter freeze.

Within the context of this narrow appraisal, the partisans are mostly correct. Attempts to bring more pipeline gas to New England have come to grief, especially in New York state where residents have strongly opposed new natural gas pipelines and storage facilities.

In addition, the state banned hydraulic fracturing—the main method for extracting gas from the Marcellus and Utica deposits—in 2014, claiming the process threatened water supplies. That ban, of course, prevented any shale gas development in southern New York under which the deposits lie. And, it brought into disrepute all things related to hydraulic fracturing or "fracking" including natural gas pipelines and storage facilities.

What lurks behind the outrage of the partisans is the assumption—widely touted in the media and by the U.S. Energy Information Administration (EIA)—that the country is about to become a large exporter of LNG for the long term as its natural gas production grows ever skyward. Energy abundance, they like to say, has arrived in America.

There's just one problem—or should I say four? Of the six major U.S. shale gas plays that are the basis for the optimism about supply, four are already in steep decline. (Gas produced from other types of deposits has been either flat or in decline for many years.) As of the end of 2017 the rate of natural gas production in the Barnett play in Texas, the Fayetteville play in Arkansas, and the Haynesville play spanning the area where Arkansas, Louisiana and Texas meet are all coincidentally down by about the same 44 percent from their peaks years ago. The Woodford play is down about 25 percent from its 2016 peak.

That leaves only the Marcellus and Utica plays mentioned previously to carry the United States into an era of continuously climbing overall natural gas production. That's an unlikely prospect and one rated as such by David Hughes, author of "Shale Reality Check." For his analysis, Hughes meticulously checked the actual well production histories of shale gas wells—rather than merely scanning misleading energy headlines as most other analysts seem to do.

Even the Marcellus is showing its age as the rate of production from new wells sags, a sign that the most productive prospects have already been drilled. In addition, a preliminary production peak in the Marcellus in early 2017 waits to be confirmed.

If the optimistic scenarios for U.S. natural gas production fail to materialize as seems likely, we will almost certainly see more LNG-related irony as imports and exports occur simultaneously at the country's LNG terminals. This is because long-term delivery contracts entered into by LNG export terminals will prevent any rerouting of gas bound for export to domestic use, possibly even under emergency conditions. If the shale gas boom fizzles, we will discover that government approvals for U.S. export terminals were wildly ill-advised as more LNG delivery ships dock near Boston and other places to make up in part for outgoing U.S. LNG cargoes .

Silver Market Poised For Bullish Trend

Silver is completely “off the radar” for most investors right now which is just the way we like it when we are buying, however, as we will see, there are good reasons to believe that this will not be the case for much longer.

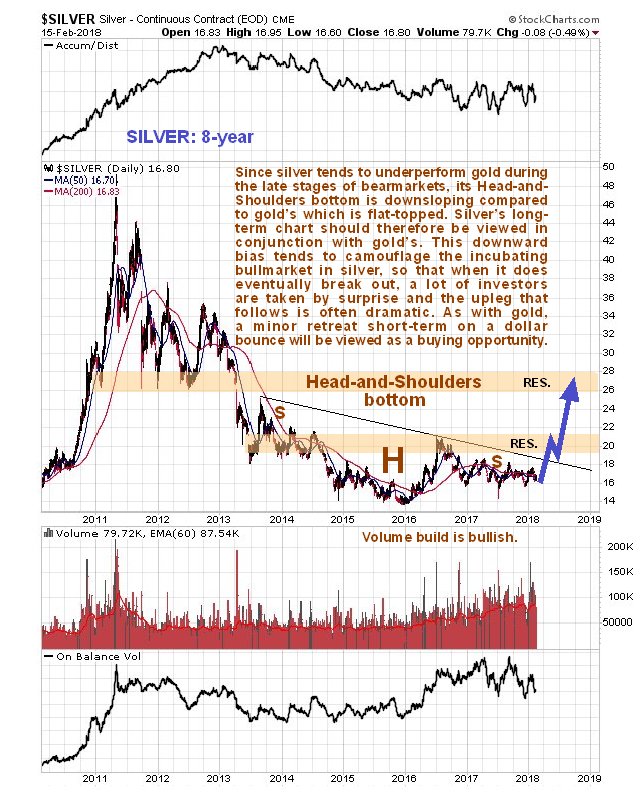

On its latest 8-year chart, we can see why silver has zero appeal for momentum traders now – it ain’t goin’ nowhere, or so it would seem, if you project past performance into the future, but as we have repeatedly observed in recent months, it is marking out a giant Head-and-Shoulders bottom, which is quite heavily disguised compared to the concurrent flat topped H&S bottom forming in gold, because it is downsloping. A key bullish point to observe on this chart is the steady volume buildup over the past 2 years, which is a sign that it is building up to a major bull market. This hasn’t had much effect on volume indicators so far, but such is not the case with gold, where a more marked volume buildup has driven volume indicators strongly higher so that they recently made new highs, which bodes well not just for gold, but obviously for silver too.

Silver Daily Chart

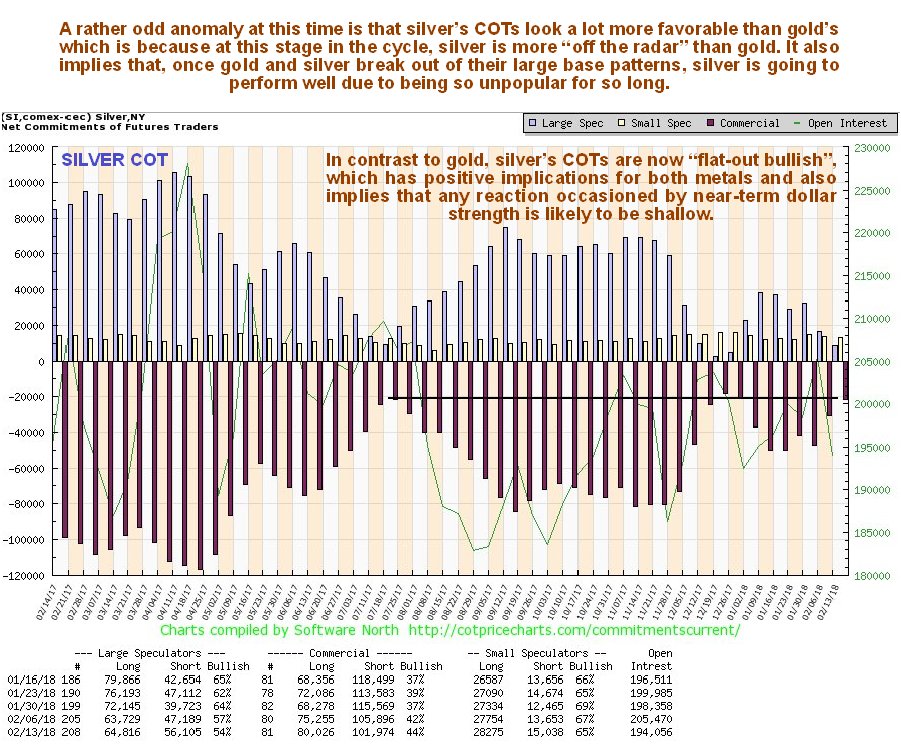

Moving on to observe recent action in more detail on the 6-month chart, we see that silver dropped back further than predicted in the last update, which is hardly surprising considering what happened to the broad stock market. No technical damage was incurred, however, and it has already clawed back a part of the loss. What now? – like gold, silver may drop back again short-term on another modest dollar rally, which appeared to have started on Friday, and any such drop will be viewed as presenting another opportunity to accumulate more silver and silver related investments, especially given silver’s latest COTs which are “flat-out bullish” as we will now proceed to see.

Silver 6 Month

The latest COTs show that the Large Specs have “thrown in the towel” on silver and gone home – great! – that’s what we like to see. This extremely low level of Large Spec long positions is very bullish indeed for silver and also implies that gold could soon rally too, despite its COTs not being so positive, although as mentioned above both metals are likely to have to weather a modest dollar rally first.

In summary, whilst a minor short-term dip on a modest dollar rally looks likely, silver’s chart are very bullish overall as it appears to be readying to break out of it giant Head-and-Shoulders bottom. Any near-term weakness will therefore be viewed as presenting an excellent and possibly final chance to accumulate silver and especially silver stocks at very low prices ahead of major sector-wide bull market commencing.

India Posts Robust Oil Data

The oil continues to bullishly run on the market as India’s January results were peaking at a new record high. Crude imports were skyrocketing in the previous month, a large number of refinery runs and the growing refinery capacity also pushes the strong demand and what a handful of analysts dub as the “strong recovery”.

The striking oil news from the country is buoying the oil prices in the market and a lot of investors and market analysts are looking at the possibility of the record high reports in India can sustain and support the ongoing bullish prices in the future.

Indian Oil Figures

Looking at the country’s January oil imports, they managed to tally a whopping 13.6% increase against the January 2017 figures and tallying a massive 12.5% increase versus the figures from the latter month, December 2017’s.

According to reports, the country’s state-owned refineries garnered a whopping two-thirds of the incredible 5 million barrels per day that the country has pushed in the previous quarter. Reports also revealed that the country has been looking to rally the run rates for January until March of this year to meet the targets the government declared.

Furthermore, the high imports and run rates have also been stemming from the highly anticipated spring maintenance in the country’s local refineries. This managed to increase the great results alongside the strong demand and refining margins. Analysts also stated that the country has been running a massive barrels per day production, peaking at 5.27 million bpd.

Bullish Price on Higher Imports

The previous robust import data from India last January is already taking the over the market as analysts and economists are debating on what this can actually mean for the oil prices in the future. Analysts are debating on whether the robust import can keep the oil prices bullish the in the future and eventually impact the benchmark future prices as well.

According to the Indian government, the local annual fuel demand was up by a massive 10.3% from the prior month. Meanwhile, the consumption of diesel and gasoline were also up from the previous month by double-digit figures.

Analysts noted that it is going to be possible given that the country continues to boost their manufacturing in the next few years. According to reports, India is looking to attain just that with a massive 2030 target; they revealed their plans on increasing the refining capacity by a whopping 77% by that year to an 8.8 million barrels per day production.

Subscribe to:

Comments (Atom)

Followers

Stock market updates

buy LT 3800-3810 stop loss 3780 target 3835/3900/3950

-

buy LT 3800-3810 stop loss 3780 target 3835/3900/3950

-

At Nagpur market , Soybean Plant ended lower at Rs. 3250-3300 per quintal, lower by 1.49 per cent as compared to previous day. Soybean Mandi...

-

buy bank nifty@49200 sl 49000 target 49400/49600/49800 Recommendation: Buy Bank Nifty @ 49,200 Stop Loss (SL): 49,000 Targets: 1st Target: ...