We kickoff the Chinese New Year’s Eve with Export Sales, Jobless Claims and PPI at 7:30 A.M. Followed by Capacity Utilization and Industrial Production at 8:15 A.M., EIA Gas Storage at 9:30 A.M. and NOPA Crush at 11:00 A.M. On the Corn front the market is monitoring the drought in Argentina’s Pampas grain belt which is likely to continue in the second half of February with no rains in sight. The three month dry spell led the U.S. government and the Bueno Aires Grains Exchange to cut harvest estimates for Argentina, the world’s top exporter of Soymeal Livestock Feed and it is the number 3 supplier of Corn and Raw Soybeans. In the overnight electronic session the March Corn is currently trading at 367 ¾ which is a ½ of a cent higher. The trading range has been 367 ¾ to 366 ½.

On the Ethanol front rollovers are starting up with the April contract picking up activity, which will begin the start of the summer driving season early with Easter coming early this year. In the overnight electronic session the March contract is currently trading at 1.461, which is .007 of a cent higher. The trading range has been 1.466 to 1.459. The market is currently showing 1 bid @ 1.463 and 1 offer @ 1.467 with 6 contracts traded and Open Interest at 1,019.

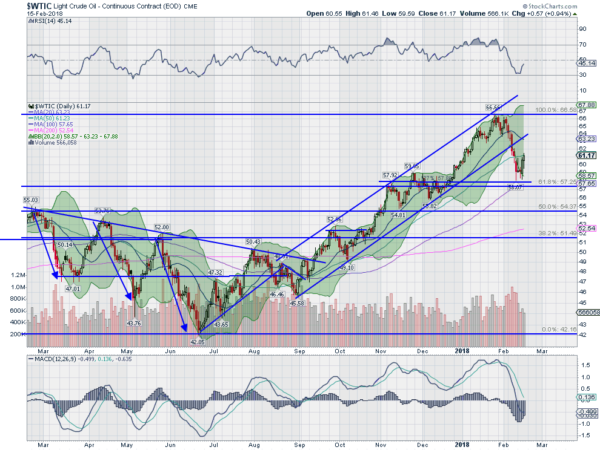

On the Crude Oil front the market is easing off of yesterday’s price spike. In the overnight electronic session the March contract is currently trading at 6021, which is 39 points lower. The trading range has been 6155 to 6018. The market could retest the highs with the Stock Market roaring again and the continuation of the U.S. dollar selloff.

On the Natural Gas front we have the weekly EIA Gas Storage and the Thomson Reuters poll with 25 analyst participating expect draws anywhere from 162 bcf to 207 bcf with the median 184 bcf. This compares to the one-year of 92 bcf and the five-year average of 145 bcf. In the overnight electronic session the March Natural Gas is currently trading at 2.557, which is 3 cents lower. The trading range has been 2.623 to 2.530.

Have a Great Trading Day!