The stock market continues to recover from its first 10% correction in almost 2 years. But did you notice that crude oil also had a better than 10% correction? This was caused by over supply and the US overtaking the Middle Eastern oil producers in capacity, or so the pundits would have you believe. Others will tell you it is from the unwinding speculative long positions in the futures market. Think about that one. oil prices are falling because people are selling it. Really? Pay the pundit.

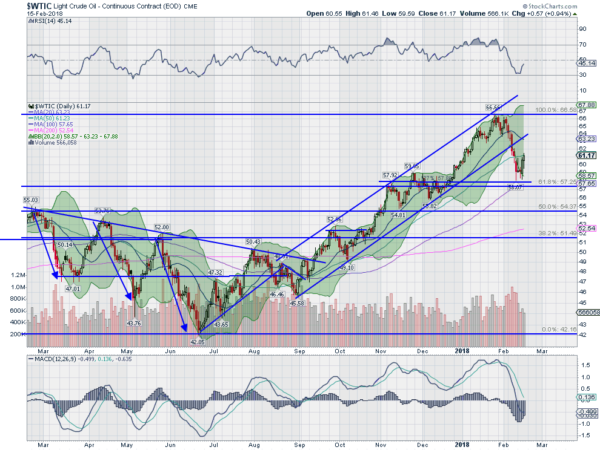

Why can’t oil prices fall for the same reason that any prices fall, changes in sentiment. Did you notice that oil fell at the same time as the broad stock markets after also going through a long run higher? A quick look at the chart of West Texas Intermediate crude oil shows the price running higher in a channel from a low around 42 to its high over 66. After a double top there it pulled back nearly 38.2% of the move higher, finding support at the 100 day SMA and prior resistance. Momentum also reset lower with the RSI pulling back out of overbought territory down to near oversold. The MACD also reset near zero.

WTIC Chart