sell nifty @ 10850 sl 10920 target 10700/10600 holding

Nse trader, mcx traders, ncdex traader ,stock futer trader ,options trading

Wednesday, 13 June 2018

Monday, 11 June 2018

Friday, 8 June 2018

Thursday, 7 June 2018

Wednesday, 6 June 2018

Tuesday, 5 June 2018

Monday, 4 June 2018

Wednesday, 30 May 2018

Vedanta Price Action Analysis On Long Term Trend – Reversal Attempts

Some radical changes are taking place in Vedanta share prices. Long term trendplays a major role in Stock Analysis. Any changes in long-term trend can influence the market behavior and Price action on all time frames. That’s the case in Vedanta stock prices. Since beginning of 2018, shares tumbled from the high of 350. Price action is forming some sort of trend reversal structure on Long term trend. Weekly chart shows both the uptrend and recent price behavior clearly

Even when Fundamentals are not clear, Stock prices tend to move with some hidden motivations and Interests. Having a proper knowledge on Price action – chart reading is one of the best ways to understand Market psychology and spot market turning points. Vedanta Shares started to slip from Jan 2018, seems like some prominent insiders sold the stock even before Sterlite copper plant issues popped up. Once the news become public, selloff intensified and Investors liquidated their positions in Panic.

If we look at the weekly chart, it’s easy to understand the Market activity from a structural context and make sense of Market behavior. A Trend reversal attempt is taking place after an extended uptrend and fundamentals are driving the market prices. We refer them as trend reversal attempts because these types of price action often lead to trend terminating. What might happen this time? Will the trend reverse or would it continue further? Observe the Developing price action and trade accordingly. Also remember that this is a long-term trend, so share prices can become highly volatile, so think about Risk management before initiating any trades.

Tuesday, 29 May 2018

Monday, 28 May 2018

to day profit cipla @ 7000 dr reddy @5000 total profit @12000

to day profit cipla @ 7000 dr reddy @5000 total profit @12000

Friday, 25 May 2018

Do you want to earn monthly some income from stock market? Have you lost from stock market and want recover your loss?

Do you want to earn monthly some income from stock market? Have you lost from stock market and want recover your loss?

Then try my advisory services. Earn monthly minimum 100000

and above on consistent basis on my Positional calls on NSE FUTURE or CASH

and above on consistent basis on my Positional calls on NSE FUTURE or CASH

segment. Minimum investment required to trade is 3-5lakhs 🗝🗝🗝and above. Interested clients who are very serious can PING me on my WHATSAPP 8885237899 We provide advisory services on 25:75 profit sharing basis.🏹🏹🏹

segment. Minimum investment required to trade is 3-5lakhs 🗝🗝🗝and above. Interested clients who are very serious can PING me on my WHATSAPP 8885237899 We provide advisory services on 25:75 profit sharing basis.🏹🏹🏹Disclaimer : I am not sebi registered advisor

ACCURACY above 90-95%

Please contact me only serious clients who want to earn some monthly income....

Thursday, 24 May 2018

Wednesday, 23 May 2018

Tuesday, 22 May 2018

Monday, 21 May 2018

Friday, 18 May 2018

AUD/CAD finds stiff resistance at 21-ema at 0.9673, good to go long on break above

-

AUD/CAD breaks above 5-DMA at 0.9624, trades 0.18% higher on the day

at 0.9633 levels.

-

The pair finds stiff resistance at 21-EMA at 0.9673, breakout at

21-EMA could see further upside.

-

Technical studies are turning slightly bullish. Stochs have shown a

rollover from oversold levels.

-

We also evidence bullish divergence on RSI and Stochs which adds to

the bullish bias.

-

Breakout at 21-EMA will see test of 23.6% Fib at 0.9716. Further

bullishness could take the pair to 50-DMA at 0.9811.

- On the downside, we see major trendline support at 0.9550, break below will see resumption of weakness.

Resistance levels - 0.9716 (21-EMA), 0.9785 (Nov 30 high), 0.9811 (50-DMA)

Recommendation: Watchout for breakout at 21-EMA to go long. Target 0.9716/ 0.9811.

USD/ZAR rejects key resistance at 12.62 Mark, bias remains slightly bearish

- USD/ZAR is currently trading around 12.52 levels.

-

It made intraday high at 12.62 and low at 12.51 levels.

-

Intraday bias remains slightly bearish till the time pair holds key

resistance at 12.62 mark.

-

A daily close above 12.62 will take the parity higher towards key

resistances around 12.78, 12.86, 12.96 and 13.15 marks respectively.

-

Alternatively, a daily close below 12.42 will drag the parity down

towards key supports at 12.20, 12.02, 11.94, 11.84, 11.70, 11.62 and

11.53 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart. Current downside movement is short term trend correction only.

GBP/JPY trade idea

-

GBP/JPY is continuing its upward momentum and jumped almost 80 pips

from Wednesday close. The pair has closed slightly above 200- day MA

and this confirms minor trend reversal. It has jumped till jumped

till 150 at the time of writing The yen was trading weak against all

majors today on account of easing geo political tensions . USD/JPY

trades higher and hits high of 111. GBP/JPY has taken support near

trend line and any minor weakness only below 147.05. It is currently

trading around 149.72.

-

The pair is facing strong resistance at 150 and any convincing break

above 150 will take the pair to next level till 150.64 (100- day

MA)/151/152.80.

- On the lower side, near term major support is around 149 and any decline below will drag the pair to next level till 148/147.

Resistance

R1- 150

R2 –150.65

R3- 151.50

Support

S1- 149

S2-148

S3- 147

EUR/NZD breaks below 20-dma, on track to test 50-dma at 1.70, stay short

-

EUR/NZD extends slump below 20-DMA, on track to test 50-DMA at 1.70.

-

The pair is trading in a rising channel pattern and is extending

downside after rejection at channel top.

-

The pair has formed a 'Shooting Star' at highs and we see scope for

further weakness. Bears now target 50-DMA at 1.70.

-

Technical indicators are turning bearish and violation at 50-DMA will

see further weakness.

-

Stochs are showing a rollover from overbought levels and RSI has

turned lower from near overbought levels.

-

Break below 50-DMA will take the pair lower till next major support at

110-EMA at 1.6925 ahead of channel base at 1.6740.

- On the flipside, retrace above 5-DMA will see test of channel top at 1.7285. Break out at channel top negates bearish bias.

Resistance levels - 1.7164 (5-DMA), 1.72, 1.7285 (channel top)

USD/CHF downside capped by 20 –day ma, good to sell on rallies

-

Major resistance – 1.0060

-

USDCHF has shown a minor decline till 0.99575 and started to recover

from that level. The pair almost formed almost a double top at 1.00560

and started to consolidate within narrow range. Any convincing break

below 0.9945 (20- day MA) confirms minor weakness and a dip till

0.9900 is possible.

- The pair’s further bullish continuation can be seen only above 1.0060 level. Any break above 1.0060 will take the pair to next level till 1.010/1.0170 level. The safe haven such as yen has been declining sharply

- In this week the pair jumped till 1.00415 and started to decline from that level. So intraday trend is still weak and any convincing close below 1.000 confirms minor bearishness.

EUR/USD daily outlook

-

EUR/USD is consolidating in narrow range and trading slightly weak 25

pips above 2018 low. The pair pared some of its gains in European

session. The pair weakness was mainly due to rising US 10 year bond

yield. The yields hits fresh 7 year high at 3.10% yesterday. The

leaders of Italy’s two political party M5S and League agreed to form a

government. So no threat for Euro. It is currently trading around

1.17862.

-

The number of new people filing for U.S jobless benefits increased

more than expected. Initial claims for unemployment benefits rose to

222K

compared to forecast of 215k.

-

On the higher side, near term major intraday resistance is around

1.1850 (hourly Kijun-Sen) and any break above will take the pair to

next level till 1.1875 (200- H MA)/1.19215 (23.6% fibo)/1.1950. Short

term bearish invalidation only above 1.2020 (200- day MA).

- The near term support is at 1.1750 and any convincing break below will drag the pair to next level till 1.1715/1.1660.

Thursday, 17 May 2018

Wednesday, 16 May 2018

UPDATE 1-Suspected Indian central bank interventions stems rupee's fall

Indian rupee unexpectedly gains on strong RBI intervention

* India bonds also gain taking comfort from rupee

* Rally at risk as macro risks, high oil weigh (Adds details, quotes, bond level)

By Suvashree Choudhury

MUMBAI, May 16 (Reuters) - Suspected currency market intervention by the Reserve Bank of India for a second consecutive day stemmed the rupee's fall, three dealers said after seeing heavy dollar selling from the outset of trade on Wednesday.

The rupee INR=D2 had weakened to a 16-month closing low of 68.15 per dollar on Tuesday, but after the latest round of suspected central bank support it had bounced back to 67.80, despite the dollar's strength on international markets.

"It looks like RBI is in a mood today," said a senior dealer at a state-run bank, estimating that within the first 10 minutes the RBI might have sold $300 million to $400 million proactively to prevent any sharp fall in the rupee.

Sharply rising U.S. dollar yields have boosted the dollar on international exchanges, and the rupee was also coming under pressure from firm crude oil prices that will weigh on India's already widening trade deficit.

Some dealers had anticipated that the RBI might refrain from intervening on Wednesday as it suspected intervention on Tuesday had failed to stop the rupee hitting its weakest level since January 27, 2017.

The rupee swung in nearly one percent intraday range on Tuesday, its most volatile day in about a year. can understand what the RBI wants to do with the rupee. It says it intervenes to curb volatility but sometimes it allows the rupee to move wildly and sometimes it is holding it with a heavy hand," said another dealer at a foreign bank.

Indian bond prices strengthened on the rupee's unexpected recovery.

The 10-year benchmark bond yield < IN071728G=CC stood at 7.88 percent early compared with its previous close of 7.90 percent.

However, both forex and debt traders were doubtful whether the rally in the rupee and Indian bonds would last through the week.

Indeed, bond dealers expect the yield on 10-year paper to cross the 8-percent mark, a level unseen since June, 2015, due to inflation concerns.

Forex traders also expect the rupee to breach the record low 68.8650 level, last touched on November 24, 2016.

"It is quite difficult to sustain the rally given India's weakening macro-economic parameters," said another dealer at a foreign bank.

Indian rupee has been the worst performer in the region, losing more than 5 percent so far in 2018 while inflation risks have increased on high oil prices raising the probability of faster hikes in interest rates by the RBI.

The trade deficit <INTRD=ECI > widened to $13.72 billion in April from $13.25 billion a year ago and could rise further with India importing 80 percent of its oil needs.

Gold's Bearish Breakout-In-Progress Confirms USD Strength

More than any other asset, gold invokes strongly defended positions among both its proponents and detractors. Whether you believe gold is “historically the only true form of hard money” or “just a yellow rock with few industrial uses,” it still pays to keep an eye on the price action and evaluate the current trend.

For more than two years, gold hasn’t shown much of a trend at all, with prices consolidating between $1200 and $1400 (excluding a brief spike down to the mid-$1100s in Q4 2016). More recently, the metal has spent the entire first third of 2018 trapped between $1300 and $1365, frustrating bulls and bears alike.

That may be changing with Tuesday's price action: as of writing, gold was trading hands below $1300, down by more than 1.5% on the back of a breakout in US Treasury yields and the accompanying greenback rally:

Daily Gold

Of course, bears have been wrong-footed by failed breakouts before, so it may be worthwhile to wait for a daily close to confirm the breakdown. That said, gold is currently trading well below the 50% retracement of the December-January rally, opening the door for a continuation down toward the 61.8% ($1286) or 78.6% ($1264) retracements next. Astute readers will note that the 1260 area provided support twice back in October of last year.

Taking a step back, Tuesday’s breakout-in-progress serves as a confirmatory indicator of the recent dollar strength. From an intermarket perspective, as long as gold remains below $1300, it will support the near-term “bullish dollar” thesis.

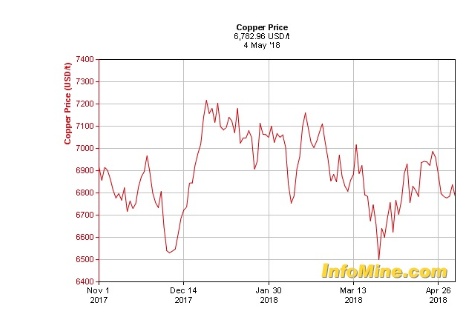

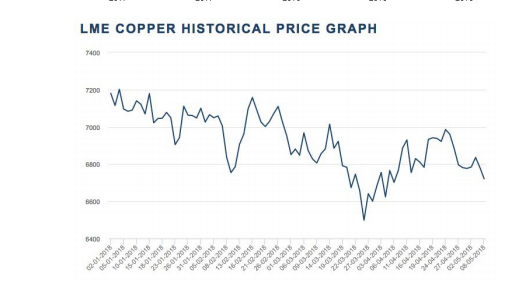

The Coming Copper Crunch

Copper had one of its best years ever in 2017, rising 27% on the back of supply disruptions and steady demand from China, by far the largest copper consumer.

Commodities analysts are usually wrong about copper supply, always predicting a glut in the market for the ubiquitous metal used in everything from piping for plumbing to wiring in houses, to components of electric vehicles. What they fail to account for is the inevitable stoppages at the major copper mines due mostly to strikes and weather problems.

Commodities analysts are usually wrong about copper supply, always predicting a glut in the market for the ubiquitous metal used in everything from piping for plumbing to wiring in houses, to components of electric vehicles. What they fail to account for is the inevitable stoppages at the major copper mines due mostly to strikes and weather problems.

In 2017 however they were right. In January last year a collection of analysts—from BMI, Goldman Sachs, Citigroup) and TD—were all bullish on copper, saying that after a terrible 2015 and 2016, it would be the strongest performing metal of 2017 with predictions of up to $6,200 a tonne come mid-year. By the end of 2017 copper futures trading on the London Metal Exchange (LME) were at their highest in four years, $7,236.50 a tonne or $3.28 a pound. Copper wasn’t the best performing metal of 2017 (that would be cobalt) but it was third behind palladium.

So how has copper done so far in 2018? The base metal is showing a V-shaped curve, with LME copper starting the year at $7,200 a tonne, bottoming out at $6,499 on March 26, and currently trades at $6,721. Spot copper follows the same pattern. It started 2018 at just under $7,200 and was at $6,782 ($3.08) as of May 4. Copper has traded up sharply since the end of March but has pulled back since the end of April.

Copper Price in USD

LME Copper, Historical Price Graph

So what's happening with the copper market and what are the prospects for junior copper companies wanting to find the next big discover to be gobbled up by a major? The article embedded below takes a look at the copper market in detail, including uses, the supply-demand trends and pricing.

However, the overall conclusion, based on the details provided, is that copper is heading for a major shortfall. That can only mean one thing: higher prices

Tuesday, 15 May 2018

Monday, 14 May 2018

Bitcoin Daily Forecast - 14 May 2018

Bitcoin outlook negative despite a bounce in oversold conditions. We are holding strong resistance at 8650/8750 and should turn lower. Holding below 8600 targets 8500 and 8350 before the low at 8210/00. A break lower is expected eventually targeting 7800 and the the most important of the week at 7550/7500. We should bounce off here on the first test to ease oversold conditions. I do not think this level will hold for ever though.

Strong resistance at 8650/8750 but shorts need stops above 8850. An unexpected break higher targets 8900/8950 and 9050, perhaps as far as 9180/9200, but look for a selling opportunity at 9250/9300.

Crude Oil Prices Up After Geopolitical Issue Eases

The oil prices were bullish in the market as geopolitical tensions in the Middle East dies down. The commodity’s prices managed to hit another milestone despite the astonishing performance of the dollar in the market.

The commodity continues to push great performance in the market on multiple factors. The great oil inventories reports and the OPEC agreement to extend the output cut have managed to put the prices on its best figures ones again.

Furthermore, the recent decision from the Trump administration was the last greatest factor that managed to buoy the oil prices in the market. The administration recently announced their plan to revokes the nuclear deal with Iran, easing some of the geopolitical tension and debacle in the Middle East.

The tension mostly came from the Iran and U.S.A. deal which also dragged the commodity’s prices down in the market this week. Most of the pressure came from the announcement of the U.S.A. about rethinking the possibility of leaving the Iran nuclear deal which will, in return, severely affect the ongoing oil exports from the country.

Oil Prices

Both the Brent Crude and the U.S. West Texas Intermediate were tallying greater returns in the market today. The Brent crude managed to increase by a massive 19 cents in the previous session, settling at a $77.40 a barrel.

The West Texas Intermediate or WTI also managed to hit the lucrative $71 per barrel price on the same market session. The deliveries for June in the New York Mercantile Exchange also managed to increase by a total of 22 cents, settling at $71.36 a barrel.

Furthermore, the oil price increases just after the Treasury Secretary expressed his thoughts on the oil prices on a previous report. Secretary Steven Mnuchin noted that he is not expecting a huge market movement in the coming session as countries is reportedly increasing their output to offset some of the losses they experienced.

Last week’s oil prices were also pressured after their tremendous run. The stockpiling oil inventories are looking to take hold of the oil prices this week as they keep pestering the global stock figures. According to reports, the Oklahoma storage hub was up by a total of 479,644 barrels to the terrifying 39.56 million barrels.

Analysts are also looking for the possibility of the oil prices running unexpectedly wild. Some of reports and analysis are pointing that the prices may hit the $100 price per barrel just before the year ends.

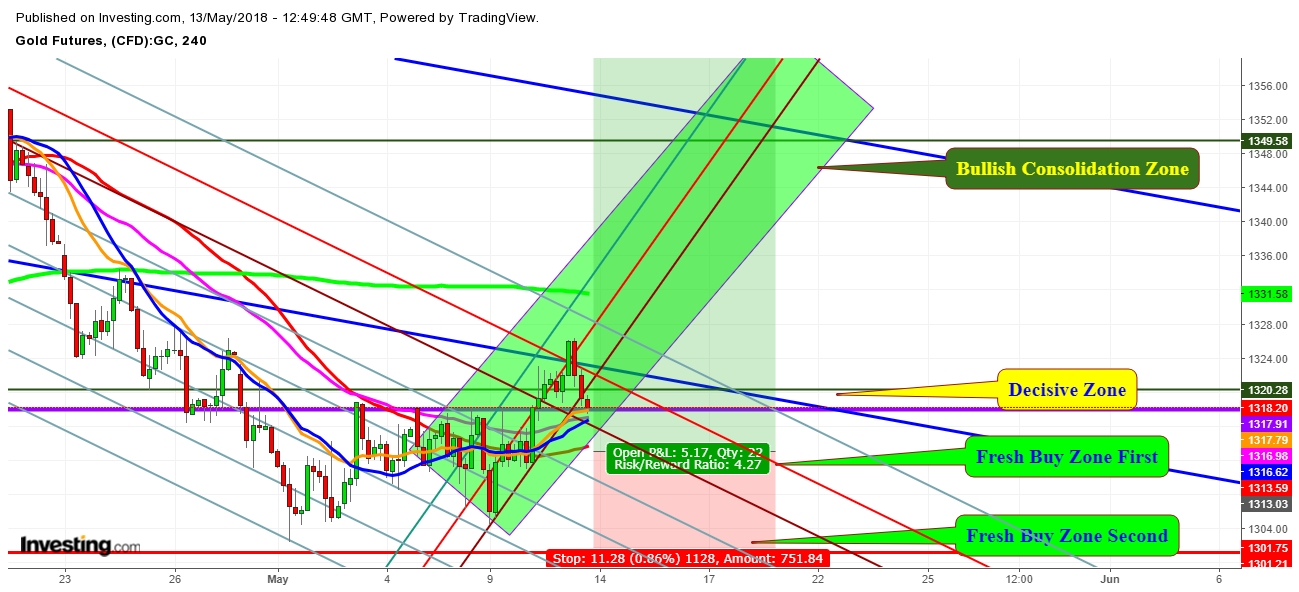

Gold: Outlook For The Week Of May 13th, 2018

Since my last analysis, Gold futures have found good support at the level of $1318 and look ready to retreat towards $1329 and further to $1355 levels during the upcoming week.

I expect Gold futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

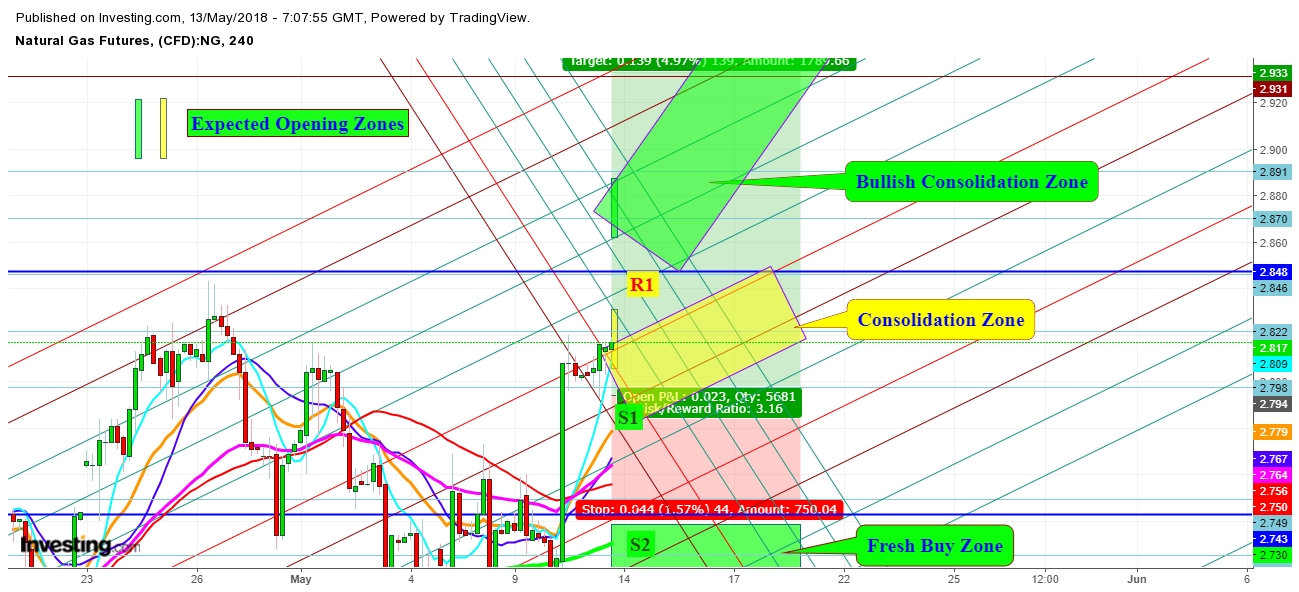

NG Looks To Consolidate In Upper Range During Week Of May 13th, 2018

Since my last analysis, I've found that Natural Gas Futures look ready to consolidate in an upper range now. Amid the expected impact of supply and demand, the equation is about to tilt from decreasing demand during winter to growing demand with the above-average temperatures covering most of the country through mid-May. No doubt that the record high domestic production levels have overshadowed the fact that gas stocks are well below their seasonal averages for this time of year. Such scenario during mid May to last week of June always results in growing volatility.

I expect the Natural Gas futures to move in the following trading zones during the week of May 13th, 2018.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Subscribe to:

Comments (Atom)